Sustainable Finance Advisory

Enabling organizations to secure capital, strengthen project resilience, and drive sustainable growth across evolving industries.

We help transform complex developments into financeable, future-ready projects through clarity, strategy, and execution-focused guidance.

What We Deliver

-

Project Finance Structuring

Designing bankable capital structures, financial models, and approval-ready documentation—supporting lender engagement, risk alignment, and financial close for sustainable projects.

-

Investment & Strategic Partnership Advisory

Connecting investors and strategic partners through feasibility review, value-chain analysis, and deal structuring—supporting capital raising, technology partnerships, and JV formation for scalable sustainable projects.

-

Credit Enhancement & Risk Mitigation

Identifying and addressing lender concerns by refining guarantees, covenants, collateral structures, and financing terms—strengthening bankability and reducing project risks across technical, financial, and operational dimensions.

-

Green & Transition Finance Advisory

Assessing environmental impact and taxonomy eligibility, quantifying emissions reduction, and structuring green or transition financing that aligns technical operations with lender sustainability requirements and KPI targets.

-

Financial Due Diligence & Feasibility

Conducting on-site technical, operational, and environmental due diligence—combined with commercial and financial feasibility analysis—to assess project viability, identify key risks, and support investor and lender decision-making.

-

Restructuring & Turnaround Advisory

Stabilizing distressed or stalled projects by restructuring financial, contractual, and operational elements—aligning lenders, sponsors, and contractors to restore liquidity, restart operations, and regain project viability.

We blend financial modeling, on-site due diligence, and risk-managed structuring to create bankable, transparent financing solutions aligned with global sustainable finance standards. Our end-to-end support—from feasibility to execution—helps stakeholders secure capital, mitigate risks, and accelerate project delivery.

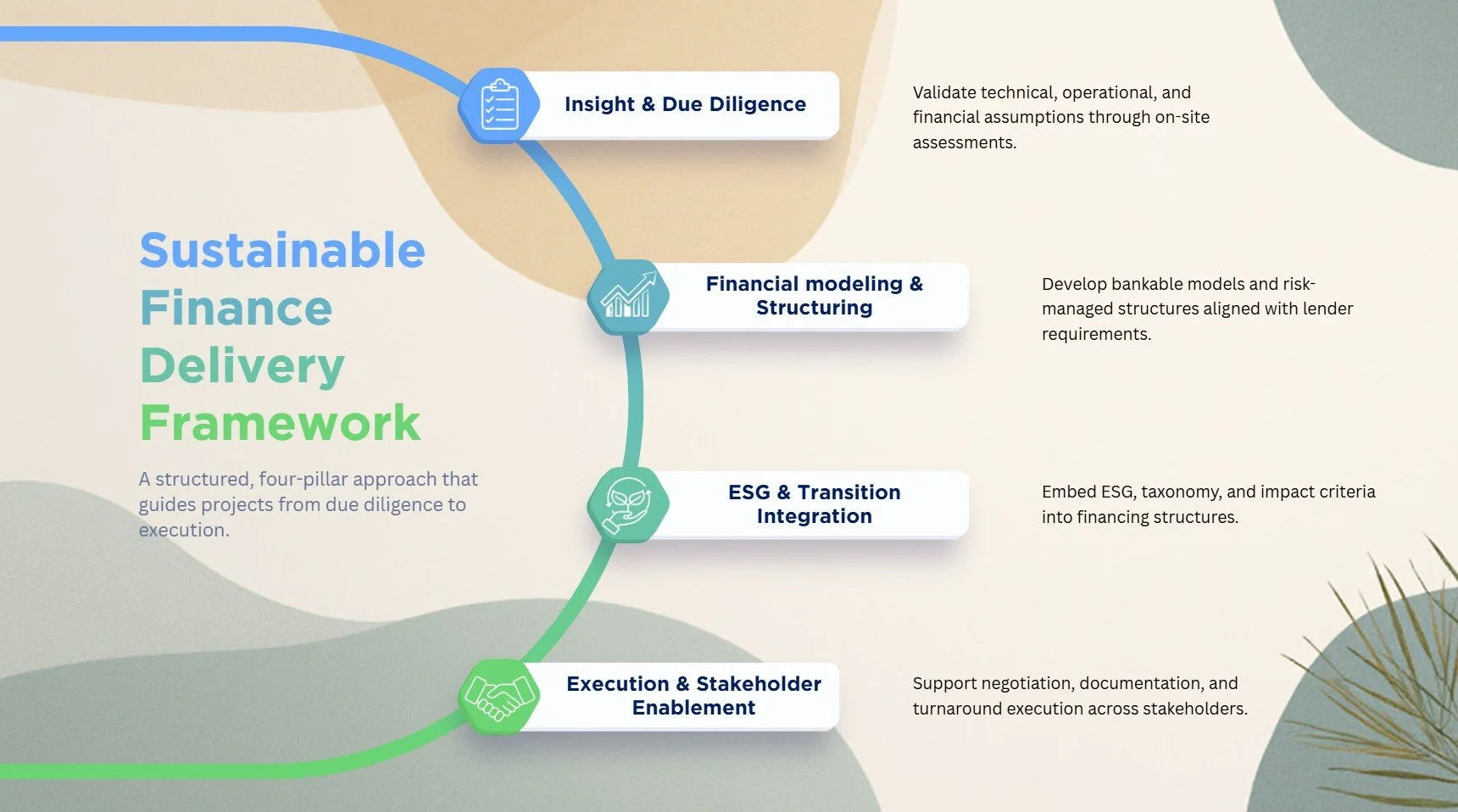

How We Deliver

Pillar 1 — Insight & Due Diligence

On-site technical, operational, and financial due diligence to uncover risks, validate assumptions, and establish a credible foundation for investment decisions.

Pillar 2 — Financial Modeling & Bankable Structuring

Robust financial modeling and risk-managed structuring that align projects with lender requirements—ensuring bankability, transparency, and long-term investment credibility.

Pillar 3 — ESG & Transition Integration

Embedding ESG frameworks, taxonomy criteria, and impact metrics into financing structures to meet global sustainability and transition finance standards.

Pillar 4 — Execution & Stakeholder Enablement

End-to-end execution support, including documentation, negotiation, stakeholder alignment, and turnaround strategies to unlock capital and accelerate project delivery.

Finance Categories We Support

We structure and support a broad range of sustainable finance vehicles—from project finance and transition-linked instruments to credit enhancements and REIT-based solutions—helping stakeholders secure capital, mitigate risks, and scale investable projects.

Project & Infrastructure Finance

Structured financing for large-scale projects, including PF, limited recourse models, EPC/O&M-based structures, construction financing, and DSCR-driven cashflow frameworks.

Green, Sustainability & Transition Finance

Financing solutions aligned with global taxonomies—Green Loans, SLLs, SLBs, renewable energy financing, and transition-aligned capital instruments.

Credit Enhancement & Risk Mitigation

Designing guarantees, collateral frameworks, covenant structures, mezzanine/bridge facilities, and multi-party risk-sharing mechanisms to enhance bankability.

Real-Asset & REITs-based Financing

REIT vehicles including CR-REITs, public/private REIT structuring, sale–leaseback models, asset stabilization financing, and turnaround-focused real-asset strategies.

Why MK & Partners

Effective sustainable finance demands rigorous modeling, clear risk visibility, and alignment with global financing standards.

MK & Partners integrates all three—delivering bankable structures, execution-focused advisory, and measurable outcomes for investors and project sponsors.

Integrated Carbon, ESG, and Finance Expertise

Our cross-domain expertise connects carbon accounting, ESG criteria, and financial structuring—designing solutions grounded in both technical and investment realities.

Bankable, Investor-Ready Deliverables

We produce lender-ready models, transparent assumptions, and structured documentation that support credit committees and investment decisions.

Execution Experience Across Asia

Proven execution across Korea and Southeast Asia—bridging local project conditions with global financing standards and investor requirements.

Risk-Centered Financial Advisory

We design financial structures that minimize downside exposure, strengthen resilience, and ensure long-term stakeholder alignment.

End-to-End Support Across the Financing Lifecycle

From feasibility and modeling to investor outreach, negotiation, and closing, we support the full financing lifecycle with practical, execution-ready guidance.

Structuring with Real-World Practicality

Our recommendations are grounded in on-site assessments, stakeholder realities, and practical financing constraints—ensuring structures that work in the real world.

Ready to Advance Your Sustainable Finance Strategy?

From financial modeling and due diligence to structuring and investor engagement, we help organizations build transparent, resilient, and investment-ready financing solutions.

MK & Partners | Partnering for Sustainable Growth

Integrated advisory across carbon development, carbon markets, ESG, and sustainable finance.

Copyright © 2025 MK & Partners LLC. All rights reserved.

South Korea

812, 8th floor, 22 Nasungbuk 1-ro, Sejong City

UK Representative London, United Kingdom

North America Representative Toronto, Canada

Locations

simon.k.moon@mk-partners.net

+82 10 6211 0212

andrew.lee@mk-partners.net

anthony.choi@mk-partners.net

Contact